POWERFUL PLASTIC

Feature-packed, low-APR credit cards designed to give you convenient purchasing power backed by the local, award-winning customer service only City Bank can deliver.

How to log in

View your account balance, statements, rewards, and more.

When logging in for the first time, click "Create New User Name" and enter your personal identifiable information. Remember your username and password as you will need to enter that when logging in to view your credit card account within city.bank for the first time after creation.

City Bank Customers

If you are an existing City Bank Online Banking user, log in to your Online Banking account using the login above and click the “Credit Card” tab.

Non-Customer

If you are not a City Bank Online Banking user, log in by clicking the button below.

Non-Customer LoginQuestions

Contact City Bank Customer Service at (800) 687-2265 or Card Member Services at (877) 768-1355.

---022472c2825c-143a-4638-8bc1-a0fd94050cac.png?sfvrsn=7b25e59f_3)

Platinum

Terms and conditions

Introductory offer of 0% APR on purchases and balance transfers for 6 months. After that, the variable APR will be 14.24% to 22.24% APR based on creditworthiness. A Balance Transfer fee of 3% or $10, whichever is greater, will apply to each balance transfer. Terms and conditions

Lower APR for those that carry a balance from month-to-month

---022472c2825c-143a-4638-8bc1-a0fd94050cac.png?sfvrsn=7b25e59f_3)

Low Rate Platinum

Terms and conditions

Our lowest APR card

Introductory offer of $0 balance transfer fee on balance transfers for the first 6 months. After that, a 1% or $10 fee, whichever is greater, will apply. Terms and conditions

Great option for consolidating debt to pay down your balances on other credit cards faster or to save on interest

$99 Annual Fee Terms and conditions

---0224e17df9a2-22cb-4264-863f-3729c0ea72f4.png?sfvrsn=ef547f26_3)

Platinum Rewards

Terms and conditions

Earn 1% cash back for every dollar spent on your credit card1

Redeem cash back for a statement credit or direct deposit to your checking account

Your card earns a one-time bonus of $50 once you spend $1,000 on purchases within the first 3 months2

---0224.png?sfvrsn=894d70ae_3)

World

Terms and conditions

Receive 1% cash back for every $1 spent plus earn 2% cash back for every dollar spent on gasoline. Earn 3% cash back for every dollar spent on travel (airfare, hotel, car rental) and dining3

Your card earns a one-time $500 cash back bonus when you spend $5,000 in the first 90 days of account opening2

$95 Annual Fee after first year Terms and conditions

Apply now for your low APR personal credit card

Start earning robust rewards and take advantage of a low APR personal credit card today. It's perfect plastic backed by impeccable customer service.

Additional Features and Benefits

City Bank Mastercard® Credit Cards have some added benefits worth noting. With great features and benefits, customers can turn good deals into great ones by adding value to purchases large and small with convenience, protection and more. Welcome to a faster, safer, more convenient way to pay.

Mastercard ID Theft Protection™

Mastercard is the only payment brand that provides its U.S. cardholders with services - at no extra cost - to help you detect and resolve identity theft.

Expert Resolution Services

Expert assistance is available to help you 24/7 if you think your identity has been stolen. Call 1-800-Mastercard and you will be assigned a personal certified specialist who will guide you through the process every step of the way.

ID Theft Alerts™

This service tracks thousands of websites to identify if your personal information is being bought or sold online. Register now.

Emergency Wallet Replacement

Experts assist you in quickly canceling and re-ordering the contents of your physical wallet such as your driver's license, among other items. Call 1-800-Mastercard if you have lost your wallet and would like assistance.

To take advantage of any of these features or file a claim, simply call 1-800-Mastercard.

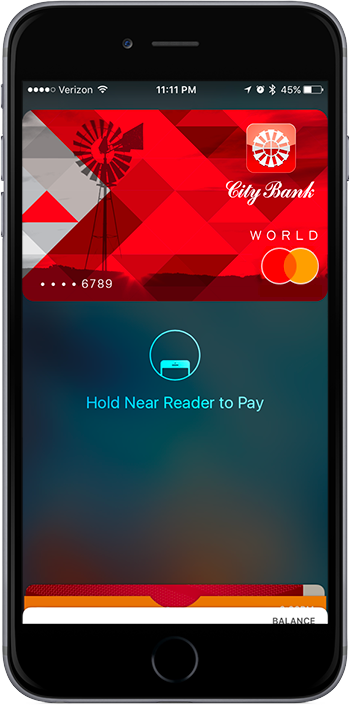

Purchase on the go with Apple Pay®

Also available for Samsung Pay® Google Pay®

Paying with your City Bank Mastercard® credit card in stores or within apps has never been easier. Our credit cards are supported by Apple Pay, the mobile payment and digital wallet service by Apple® that lets users make payments using compatible iPhones, Apple Watch, and certain iPads.

Apple Pay® is a registered trademark of Apple, Inc.

Samsung pay® is a registered trademark of Samsung Electronics Co., Ltd. Google Pay® is a registered trademark of Google LLC.

Apply now for your low APR personal credit card.

Start earning robust rewards and take advantage of a low APR personal credit card today. It's perfect plastic backed by impeccable customer service.

Questions about your credit card? Contact City Bank Customer Service at (800) 687-2265 or Card Member Services at (877) 768-1355.

Subject to Credit Approval. Ask for details. MasterCard® is a registered trademark of MasterCard International Incorporated. Certain restrictions, limitations, and exclusions apply. Please consult your Guide to Benefits for specific benefit configuration.

1For details on the Cash Back Rewards Program, please visit city.bank.myapexcard.com/apply and select Cash Back Terms and Conditions. Cash back options are subject to change without notice.

2Upon approval, a letter will

be mailed acknowledging your new account. The Cash Back Bonus period begins on the date of the new account letter and ends 90 days later.

3We group similar merchant category codes into Purchase Categories that are used

to calculate the stated cash back. We make every effort to include all relevant merchant category codes in the listed Purchase Categories. However, even though a merchant or the items that it sells may appear to fit within a Purchase Category, the

merchant may not provide us with the merchant code that will fall within that Purchase Category. Because of this, we cannot guarantee that a purchase will qualify for more than the standard 1% cash back as any purchase where a merchant uses a category

code outside of the eligible Purchase Category does not qualify for additional cash back.